The process of buying a car can be both exciting and daunting. With so many options available, it can be difficult to know where to begin. With a little preparation and knowledge, you can take control of the situation and get the car you want at a price you can afford.

There are so many things to consider: what kind of car you want, what features are important to you, and how much can you afford to spend. But don’t worry – we’re here to help make the car shopping process as smooth and stress-free as possible.

We’ve compiled a list of the top Dos and Don’ts to keep in mind. Use this guide to make your next car purchase a breeze. Happy car shopping!

- Do: Consider the Type of Vehicle You Need.

- Do: Consider Your Budget.

- Do: Make a List of Must-Haves and Nice-To-Haves.

- Don't: Skip Your Research.

- Do: Read Reviews.

- Do: Take Note of the Car's Fuel Economy.

- Don't: Overlook the Cost of Ownership.

- Do: Know Your Credit Score.

- Do: Increase Your Credit Score.

- Do: Save Up for a Down Payment.

- Do: Get Pre-Approved on a Car Loan.

- Don't: Shop Around at Multiple Dealerships.

- Do: Buy Online to Save Time.

- Do: Consider Certified, Pre-Owned Vehicles.

- Don't: Buy a Car just Because it's Cheap.

- Don’t: Miss out on Promotions and Rebates.

- Don't: Forget about Warranties and Guarantees.

- Do: Show Off Your Car!

- Congratulations!

Do: Consider the Type of Vehicle You Need.

When it comes to selecting a car, it’s important to consider the type of vehicle you need. It might help to think back on where you spend most of your time: do you spend a lot of time running errands around town or commuting to work? What about taking weekend trips out of the city? Depending on the majority of your driving habits, you may want a sedan for city life, an SUV for paddling through snowstorms and running errands, a truck for hauling, or even a van for long drives and family vacations. All of these factors are essential when making a choice so take some time to really think about what type of car will meet all your needs.

You may have your heart set on the latest luxury sedan, but if you’ve got a big family, it might not be practical for all those carpools! The same goes for gas-guzzling trucks if all you’re hauling are a few pieces of furniture. Consider the pros and cons of all your options; balancing the practicality, comfort, and affordability factor. Put yourself into good hands and make sure you weigh up all the possibilities. Before you know it, you’ll be driving away in ‘the one’.

Do: Consider Your Budget.

While you’re in the market for a vehicle, it’s important to have a clear idea of your budget before making a decision. Knowing what you’re able to spend on a car, truck, van, or SUV will help narrow down your options, search time, and avoid overspending.

Purchasing a vehicle is an important financial decision and there are many factors to consider. Before applying or heading out to the dealership, make sure to take time to develop a realistic budget that you feel comfortable with and stick to it. Once you have a target price point in mind, be aware that other vehicle features such as gas mileage, safety ratings, and interior space may help narrow down your choices.

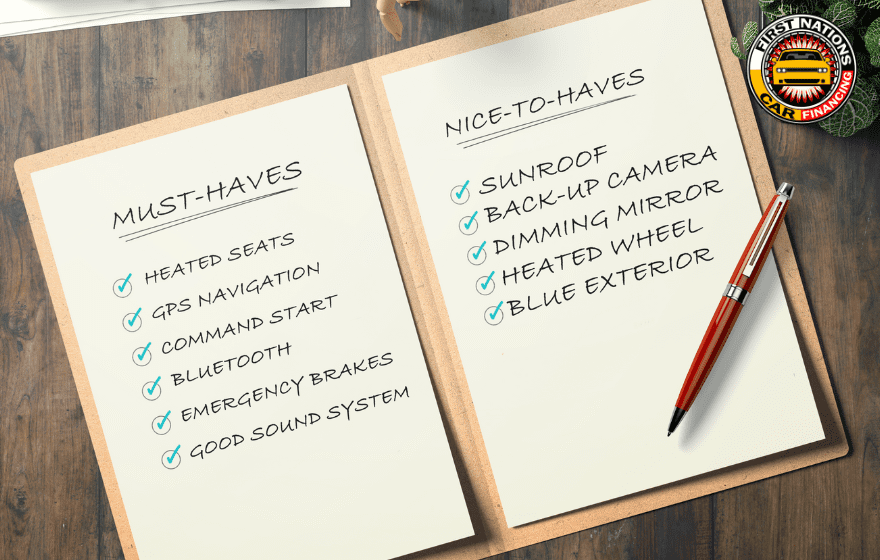

Do: Make a List of Must-Haves and Nice-To-Haves.

When shopping for a new car, it can quickly become overwhelming. But worry not! One way to make choosing your vehicle easier is to create a list of must-haves and nice-to-haves; you may even choose to rank them in order of importance. For those items considered necessary, ask yourself questions such as “Will I absolutely need this feature?” or “Is my safety dependent on this function?”

The nice-to-haves are typically the additional bells and whistles that may make your vehicle look or feel more luxurious or “cooler.” Whatever way you decide to prioritize each item, having a listing ready in hand prior to applying will help take some of the anxiety out of choosing a car – now that’s worth driving for!

Don’t: Skip Your Research.

Doing your research on available vehicle options is an essential part of any car-buying experience. You shouldn’t shortchange yourself from the knowledge you can obtain from inspecting multiple vehicles and learning about different features. Doing this research will help you determine which vehicle is the best fit for your life’s needs whether it be size, cost, safety, or style. With an abundance of models, makes, and trim levels available in today’s market, it should come as no surprise that researching your options can be time-consuming, but with the right mindset, it can also be a lot of fun!

Take the time to find out about different models, and years, understand their specific features, compare specs, and ask around. Make sure to keep an open mind and look into all tiers of vehicles – luxury, hybrid, and budget options – because you just never know what you might fall in love with. By investing time in researching all the available options, you have a surefire way of making a successful decision regarding your next vehicle purchase.

Do: Read Reviews.

Always read reviews before taking the plunge and getting yourself behind the wheel of that shiny new vehicle. Not only can you glean valuable insights from the experiences of other drivers, but you can also satisfy your curiosity about the features and specs without having to go to a lot and test drive the vehicle.

Reviewers often delve into nuances like fuel efficiency, ride quality, overall styling aesthetics, and product or dealer service. It’ll help you get an idea of how the model drives, what kind of fuel economy you can expect, and even how comfortable it is. In short — they get down to the nitty-gritty details so you don’t have to! Check out the major review sites for real-life advice from those who actually drove the cars themselves, instead of relying on flashy commercials that only have one goal in mind; to make a sale.

Reading vehicle model reviews is an important step in making the best decision for your needs. Save yourself bundles of research time by doing your due diligence with reviews before choosing your new car!

Do: Take Note of the Car’s Fuel Economy.

The fuel economy of a car is one of the most important factors to consider before making a purchase decision. After all, fuel costs are one of the biggest expenses associated with running a car. A good MPG rating on a car means that you won’t be spending too much at the gas pump and you might even find yourself enjoying longer road trips more often due to the cost savings. Don’t overlook this factor when making your decision, as it can make or break your wallet in the months and years to come! An inefficient vehicle can cost you more in gas money over the long term than you would think.

So, do your homework and find out how and where to get the best mileage out of each possible car choice. Educate yourself on modern technology such as hybrid engines or diesel power plants and if any special requirements are necessary for those vehicles depending on what region you live in. Taking note of the car’s fuel efficiency before making a purchase decision will save you time, money, and hassle in the long run.

Don’t: Overlook the Cost of Ownership.

When considering the purchase of a new car, the initial cost of the item is only one piece of the puzzle. Don’t overlook the many other costs associated with ownership! While the sticker price might appear tempting, there are additional expenses such as registration fees, maintenance costs, and ongoing insurance requirements that can add significantly to your total out-of-pocket expenditure.

Insurance costs should never be ignored. Research and get quotes for insurance on the car you want to buy, as some makes and models can be more expensive to insure than others.

Ignoring these costs could easily result in buyer’s remorse when a purchase is complete. Be sure to calculate all associated costs before signing – it may end up saving you some money somewhere down the road!

Do: Know Your Credit Score.

Knowing your credit score is one of the most important steps to take before applying for a vehicle loan. Why? Because it’s what lenders will take into account when deciding whether or not to approve your loan. Knowing your credit score before applying for a vehicle loan will give you invaluable information, such as where your credit stands, how lenders view you, and what kind of loan you may qualify for.

It’s important to give yourself the best possible chance of being approved for a loan with favorable terms. By using tools like TransUnion, Equifax, or your online banking app, analyzing your credit is actually pretty simple. Go ahead and get informed so you’ll be prepared when it’s time to apply for a car loan!

Do: Increase Your Credit Score.

Enhancing your credit score before applying for an auto loan is crucial for setting yourself up for success. Not only can it increase the odds of a prime lender taking on your loan and securing the best rates and terms available, but also help you achieve substantial savings on your vehicle purchase and prevent you from feeling financially burdened in the years that follow. With so much to gain, why wouldn’t you want to increase your credit score before a vehicle loan?

You can boost your credit score by making payments on time and in full; this might sound obvious, but late payments can harm your credit score significantly. By decreasing your debt-to-credit ratio, your interest rate costs will also be reduced and your score will quickly raise even further.

Whether it’s adding payment reminders to your calendar, setting up auto payments, or improving how you use your credit cards, there are many strategies and lifestyle changes you can make to improve your creditworthiness. Just remember that increasing your credit score isn’t an overnight success – progress takes time and effort, but is ultimately worth it when it comes to managing finances like auto financing.

Do: Save Up for a Down Payment.

Making a deposit on your dream ride is a goal within reach when you start to save up for it. Instead of breaking the bank, commit yourself to putting some money away each month and watching your savings grow. You’ll be amazed at how quickly you save up an impressive down payment and how much you can save long-term with your monthly payments being reduced.

Not only will you gain access to more expensive loans than you would have without putting a down payment, but also the smarts that come with saving responsibly. After all, buying vehicles should never put us in debt; every drive should start with a feeling of financial security. So go ahead and save up for your downpayment – it’s rewarding!

Do: Get Pre-Approved on a Car Loan.

One of the main things you need to do when car shopping is to make sure you are pre-approved for a loan before any offers and negotiations begin. Being pre-approved helps save you time, money, and hassle throughout the process and allows for a more efficient transaction overall – plus, it’s an amazing feeling to already know your loan payment before choosing a car!

Obtaining pre-approval will also ensure that you get the best possible deal on interest rates once you’ve found your new ride. Pre-approval will also help make sure that you don’t end up with a car that’s more than what your budget allows. So don’t forget – if you’re in the market for a car, be sure to get pre-approved on your loan first! Taking advantage of these great benefits will help you find a reliable car with affordable payments.

Don’t: Shop Around at Multiple Dealerships.

Shopping around at multiple dealerships may seem like a great way to find the best car deal, but it does more harm than good. You see, each dealership you visit leaves an impression on your credit report and if too many dealerships run hard inquiries on you all at once then your credit score could take a hit. This could end up preventing you from getting the loan approval you need to buy the car of your dreams!

When you shop around, it can make it seem like you are desperately trying to find a loan, and the lenders will see you as a credit seeker and risky borrower which can lower your credit score and make lenders hesitant to approve you for a loan.

The best advice is to choose one dealership and don’t disrupt your approval as it is processing. If you don’t get approved for some reason, don’t apply at a bunch of places afterward – before improving your credit score.

Do: Buy Online to Save Time.

Shopping for a car online is quickly becoming the way to go. It is one of those experiences that will top your list of modern conveniences! It’s quick, easy, and often more accessible than visiting a car dealership.

Not only do you get to browse from the comfort of your own home, but it will also save you time from commuting, and waiting in the office, and you also gain access to the best selection of cars. Plus, you won’t have to deal with pushy salespeople who pressure you into buying something when all you really want is to find the perfect car.

Instead, shop in an environment that offers unbiased information right at your fingertips and determine what works best without any distractions or inconveniences. You’ll be amazed at how effortless it is to find exactly what you need in a fraction of the time that going from lot to lot would take. So skip out on old-school approaches and see why buying your car online is the smarter (and faster) choice!

Do: Consider Certified, Pre-Owned Vehicles.

When you’re looking to purchase a vehicle, why not consider the certified, pre-owned option? Not only does this bring down the overall expense of driving a new car, as well as the cost of insuring it, but it offers quality and peace of mind. Certified pre-owned vehicles are inspected by automobile professionals to ensure that they meet the manufacturer’s safety standards, with some dealers going beyond that to give you more bang for your buck. They often come with limited warranties giving drivers further coverage if anything goes wrong.

Plus, who doesn’t love feeling like they scored a great deal? With all of these great perks included in the package, it’s no wonder certified, pre-owned vehicles are so popular! You’ll be saving money without sacrificing quality.

Don’t: Buy a Car just Because it’s Cheap.

For most car shoppers, price is the main deciding factor – but don’t let it be the only factor you consider. Before committing to that seemingly great deal, be sure to do your research and check out the car’s ratings and history to guarantee a vehicle’s quality that is reliable for years to come. Don’t settle for something budget-friendly if it was poorly maintained and has been subjected to frequent repairs and damage; it will only end up costing you more in the end.

A reputable dealer will show you the car fax report before you make a decision. A good rule of thumb is to not only consider the cost, but also the practicality and potential benefit of taking on a car purchase without emptying your pockets.

Don’t: Miss out on Promotions and Rebates.

So, you’ve finally made the decision to purchase that brand-new or new-to-you car! Congrats! But don’t forget to take advantage of all of the promotional offers and rebates that could come with your purchase. Doing so could be a great way to save some extra cash when making such an expensive purchase. Dealerships include manufacturer and dealer incentives and specials on items such as tires, extended warranties, accessories, and more – so keep your eyes open for that perfect deal or promotion. Driving off in your dream car shouldn’t have to break the bank if you do your research on those special discounts!

Don’t: Forget about Warranties and Guarantees.

When you’re buying a new car, it’s easy to get distracted by all the features, colors, and other fun things. But one thing you don’t want to overlook is warranties and guarantees on the vehicle! It’s essential to make sure that your investment is protected with coverage for anything from mechanical breakdowns to unanticipated repairs. Plus, with many manufacturers offering extended warranty options, you may be able to carry your peace of mind into the future.

A helpful finance manager will offer you different warranty options and it’s a good idea to research them thoroughly before making a rushed decision. Take a few moments to thoroughly review any warranties and guarantees so you can rest easy knowing your car is covered.

Do: Show Off Your Car!

Once you find the car that’s perfect for you, and sign the paperwork, it’s time to show it off! Take a selfie with your snazzy new car, and tell everyone how good of a deal you got on it. Taking a selfie with your car not only shares your pride and joy with the world, but it can also inspire others to take that same leap themselves.

If you bought your new car from First Nations Car Financing, a simple post like this can help bring in referrals to earn some extra cash in your pocket to help pay off your vehicle! Earn $300 – $1000 for each referred friend or family member you send our way who purchases a vehicle.

Congratulations!

You’ve now educated yourself and taken steps to get your next car. Most importantly, you know the important do’s and don’ts when it comes to buying a car – from researching the type of car you need and setting a budget to making sure to take advantage of rebates and promotions. Although the process of purchasing a new vehicle isn’t always an easy one, knowing these do’s and don’ts beforehand makes it all the simpler.

So now that you are armed with this knowledge why not use it to cruise in style? Ready to explore your options and get approved for a new car? Go ahead, open those doors and hop in – you may be surprised at how great those leather seats feel!

Take advantage of our current promotions before they expire!