A car loan can be a great way to purchase your first car. However, getting approved for a loan can be tricky if you’re a first-time car buyer. In this blog post, we’ll give you some helpful tips on how to increase your chances of securing your first auto loan.

Follow these steps and you’ll be driving off the lot in no time!

- Know Your Credit Score and History - This will give you an idea of what interest rate and terms you may be eligible for.

- Earn Good Credit History - Work towards improving your credit health.

- Choose a Car You Can Afford - Keep your expectations realistic.

- Be Prepared to Make a Down Payment - The more money you can put down on your car, the better.

- Have All Your Paperwork Prepared Before Applying for a Car Loan - This includes proof of income, license, and insurance.

- Consider A Co-Signer - Someone with good credit who is willing to sign for the loan with you.

- Avoid Shopping Around at Multiple Dealerships - We'll shop with all the major lenders and compare competitive offers for you.

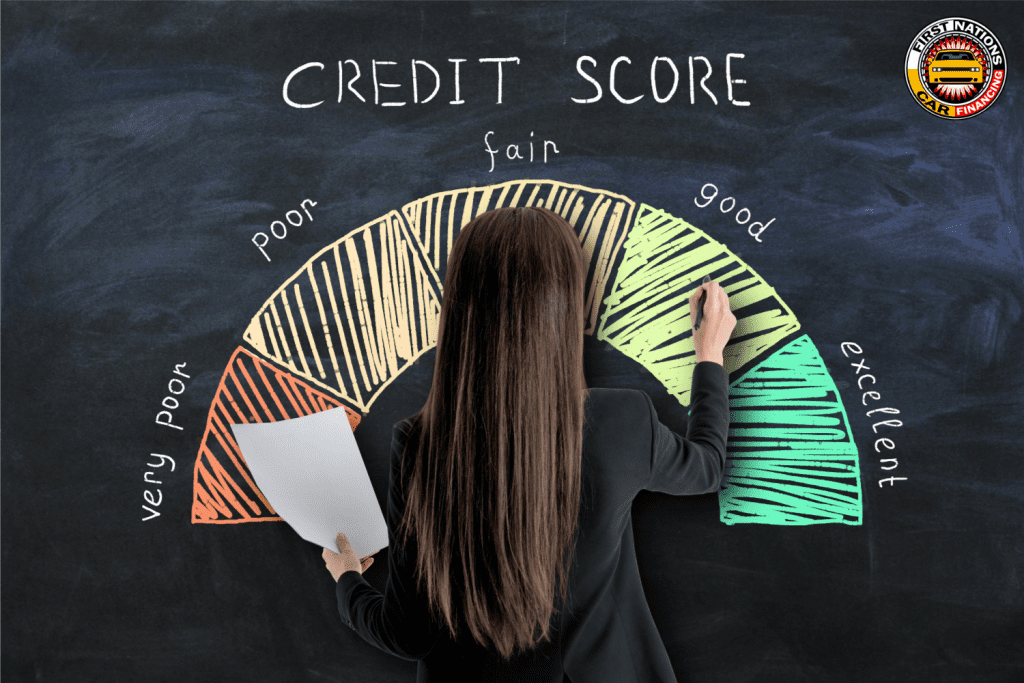

Know Your Credit Score and History – This will give you an idea of what interest rate and terms you may be eligible for.

Your credit score and history are two of the most important factors when it comes to deciding whether to approve your car loan application. It is a measure of your creditworthiness and reflects your financial history, including your ability to pay your debts on time.

Responsible financial management is paramount for anyone, and that includes managing your credit score. This three-digit number largely affects our financial lives, providing an indication of what interest rates and loan terms you may qualify for.

Before you apply for a car loan, it’s a good idea to check your credit score and report. You can get a free copy of your credit report from each of the two major credit bureaus (Equifax and TransUnion) once a year. Also, some major banks offer a free credit health check that you can keep an eye on year-round through your online banking app.

Review your credit report carefully in advance before applying for any major loans to make sure all the information is accurate. If you find any errors, dispute them with the credit bureau.

Earn Good Credit History – Work towards improving your credit health.

Working towards better credit health should always be your top priority before you apply for credit of any type. The credit score that is associated with your credit report is an important indicator of creditworthiness and it can greatly help in determining how lenders will assess your ability to pay off loans from them.

Before you start the process of applying for credit, take a look at how credit-worthy you are. A good credit score increases your chances of securing a loan or credit card, and also helps you get better interest rates with competitive deals.

If you don’t have a credit card yet, then getting a credit card 3-6 months before applying for a major loan – paying it consistently, and not having any late payments reflected on your credit bureau will show lenders that you are responsible, and have the ability to make your payments on time. If you want them to trust you with a lower interest rate, you need to earn it by paying down your bills and growing your credit score.

If you already have credit cards and there’s room for improvement, take small steps towards improving your credit history – consider creating a budget, paying down debt, and paying bills on time (you can set up direct deposit so you will never have a late payment reflected on your bureau) to correct any errors that have lowered your score. Remember that managing credit does not happen overnight; work slowly towards creating a healthier credit profile over time to ensure success in improving your credit health.

Choose a Car You Can Afford – Keep your expectations realistic.

When it comes time to choose a car, make sure you choose one that is within your budget. Don’t stretch yourself too thin by trying to get a loan for a car that’s out of your price range. Keeping your expectations realistic can help you stay within budget and comfortably afford a car that will meet your needs.

Consider the total cost of ownership, including the purchase price, financing costs, insurance, maintenance, fuel, and repairs. Also think about the features you need in a car, as well as the safety and reliability ratings before making a decision.

With all these factors in mind, choosing a car you can afford and making a smart decision will be easier and quicker than expected.

Be Prepared to Make a Down Payment – The more money you can put down on your car, the better.

When purchasing a car, it is essential to be prepared to make a down payment. Most lenders will require 10% down. Making a down payment increases your chance of getting approved for a car loan at a lower interest rate, reduces the amount you have to pay each month on the loan, and decreases the total loan cost you owe on your vehicle – saving you money down the road.

If you are able to make a down payment, statistics show that this will help you considerably when budgeting for your future car. Generally speaking, the higher the down payment you can make on your vehicle, the better it will be in terms of both financial stability and stress reduction over time.

Making a down payment shows the lender that you’re serious about purchasing a car and that you’re financially stable. It can also help you get approved for a more expensive vehicle than you would have without a down payment. So be sure to take into account how much down payment you can put down prior to buying any car!

Have All Your Paperwork Prepared Before Applying for a Car Loan – This includes proof of income, license, and insurance.

When it comes time to apply for the car loan you’ve been hoping for, you don’t want anything to stand in your way. That’s why it’s essential to have all the required papers in order ahead of time. This includes your license, treaty card (to save money on taxes), and proof of income.

You’ll need to be able to prove your income to the lender via pay stubs, bank statements, verbal confirmation, or tax returns. By taking care of these prerequisites, you can be sure that you won’t encounter any surprises along the way when submitting a loan application. Don’t let the small details become obstacles – make sure everything is in order before submitting your paperwork so that you’ll be more likely to get approved for an auto loan and be able to drive away in your new ride sooner.

Consider A Co-Signer – Someone with good credit who is willing to sign for the loan with you.

If you have little or no credit history, you may have a harder time getting approved for a car loan. In this case, obtaining a co-signer can be of great help. A cosigner is someone with a good credit score who agrees to share responsibility for the loan with you. If you can’t make your payments, the cosigner is responsible for paying off the loan, should you default on payments.

With responsible co-borrowers, co-signing can help build better financial futures for both individuals. Although it’s not always needed to get approved, having a cosigner with good credit can not only add credibility to your loan application and increase acceptance rates but can also help you secure lower interest rates and build your credit. Ultimately, co-signers are invaluable when it comes to getting loans that you may not have been able to get on your own.

Avoid Shopping Around at Multiple Dealerships – We’ll shop with all the major lenders and compare competitive offers for you.

Some people think that in order to get the best deal on a car loan you need to shop around at multiple dealerships. This couldn’t be farther from the truth.

Shopping around for a loan from multiple dealerships can put car shoppers in a difficult position that they can’t get out of. It causes their credit to be pulled multiple times and take hard hits that add up, which can lead to a decreased score and deem them as risky borrowers to the lenders for shopping around too much. It also decreases their chances of getting approved for the best possible rate and terms across all lenders.

To avoid this hassle, let First Nations Car Financing do the shopping for you! We have relationships with all the major lenders, so we can compare competitive offers and help you find the perfect loan to get the best deal possible. As the lenders compete for your business, we will do all the work and choose the right deal for you. We’ll even call them to ask to lower the rate a bit more just for you!

If you apply at multiple dealerships at the same time, the lenders will receive multiple requests for your application, and you will be deemed a risky borrower; therefore it can jeopardize our chances of attaining the best deal. If you leave it all up to us, we can secure the lowest rate possible – guaranteed.

Want to get started on your approval with First Nations Car Financing today? Apply here!